Retirees

CLIENT PROFILE

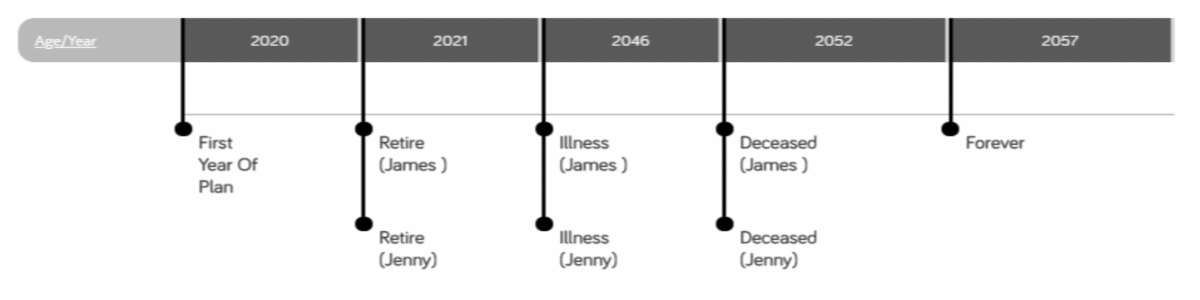

James & Jenny are 65 and wish to understand their retirement options. They have savings and pensions assets of c. £360,000. Their home is valued at £700,000 and is too large for their requirements.

Objectives & Questions

The couple wish to be financially independent throughout retirement.

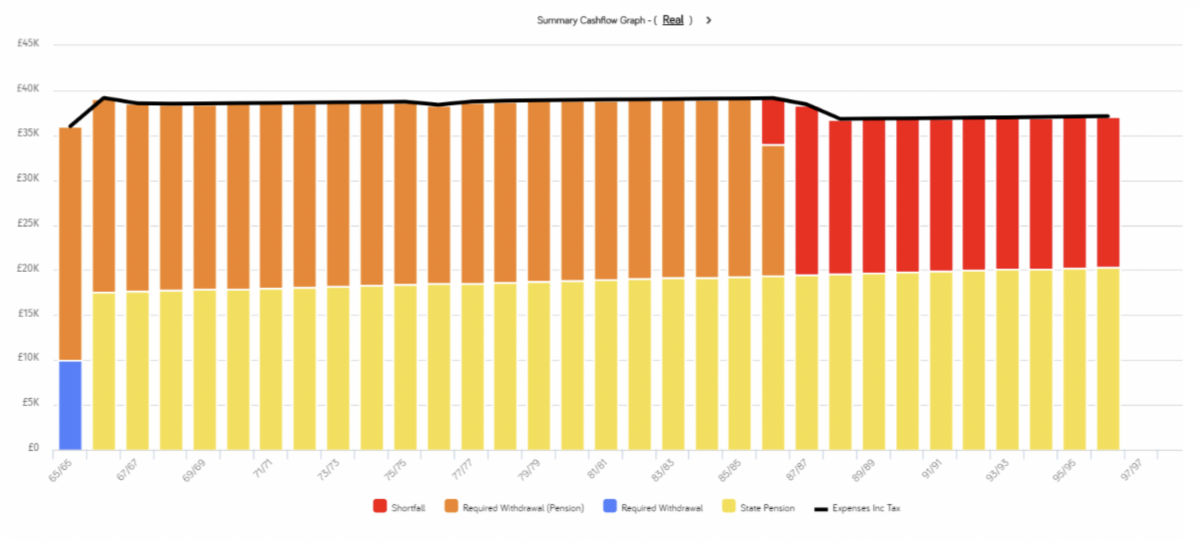

Q1) Will we be able to sustain ‘real terms’ expenditure of £3,000 pcm for our lifetimes?

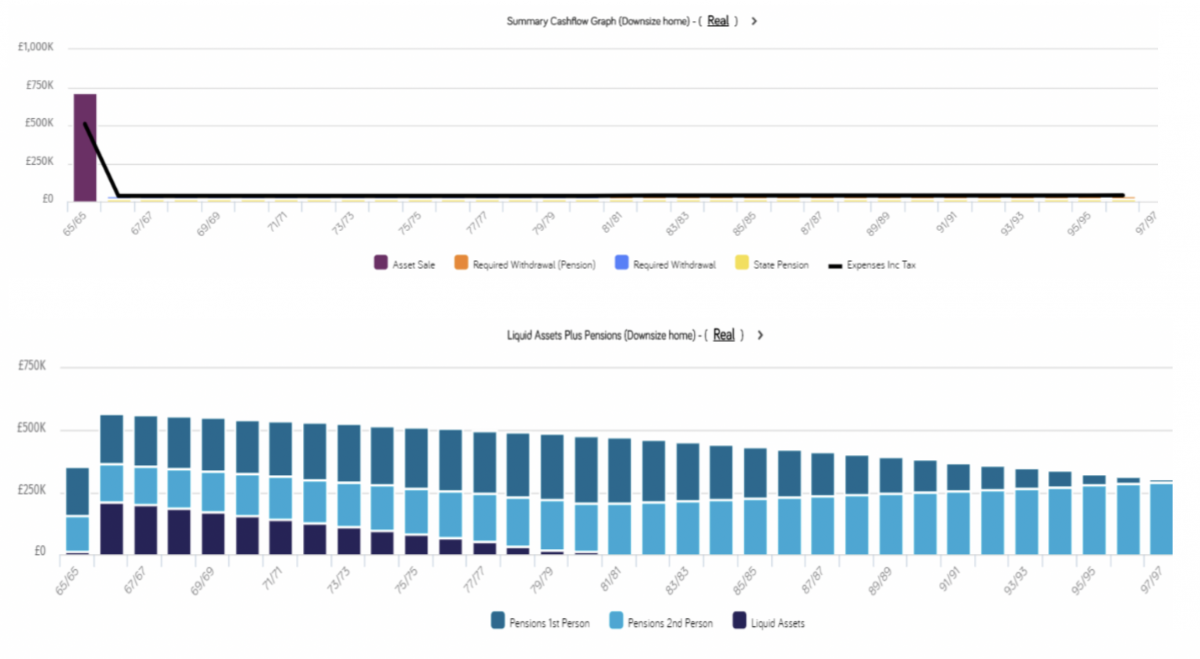

Q2) If we were to downsize at age 65 and release £250,000 of capital what impact could this have on our plans?

BESPOKE PLANNING

ANALYSIS

RESULTS

Complete Planning

SYNTHESIS ADVISED IN THE FOLLOWING AREAS:

Retirement strategy | We ensured James and Jenny had a clear plan that enabled them to move forward with their retirement plans in confidence.

Tax efficient | We will work to ensure that their income is drawn tax efficiently and that any additional funds are invested tax efficiently where appropriate.

Risk tolerance | We reviewed James and Jenny’s risk tolerance and adjusted their current investment strategy to one more suitably aligned to their views and objectives.

Independent & cost focused

INDEPENDENT ADVICE TO DELIVER COST SAVINGS

Our review indicated an appropriate pension and investment account that provided the required functionality at a very competitive cost.

Investments

We ensured that all investments were aligned to James and Jenny’s risk profile.

Connected

Solicitor | We introduced James and Jenny a firm of solicitors who were able to undertake the conveyancing for the property sale and purchase.

Reviewed

We provided James and Jenny with an annual review to keep them in control and allow for adjustments.

About this case study & risks

ADVICE | The information which is summarised in this case study does not constitute financial advice and is general in nature. It does not account for your specific circumstances and should not be acted on prior to receiving formal advice from Synthesis Connected Wealth Ltd. If you were to act without receiving advice you risk entering into a strategy and/or product that may not be suitable for your needs.

TAX ADVICE | The Financial Conduct Authority does not regulate tax advice.

INVESTMENT RISK WARNINGS | All investments, which we may undertake on your behalf, are subject to a level of risk. The value of investments and the income derived from them is not guaranteed and can fall as well as rise. A pension can not normally be accessed until age 55 (57 from 2028)

FACTUAL ACCURACY | This case study is based on a fictitious client and has been constructed to provide an example of our planning techniques.