Family Protection

CLIENT PROFILE

Alex & Louise are in their 40’s and are parents to Lucie, 10

Objectives & Questions

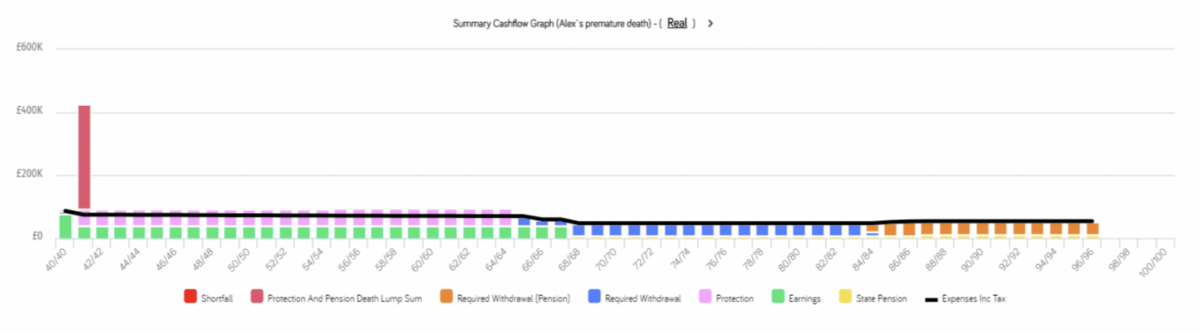

Alex wishes for Louise and Lucie to be financially secure in the event of his death

Q1) What level of protection is needed?

Q2) What type of protection products are best?

BESPOKE PLANNING

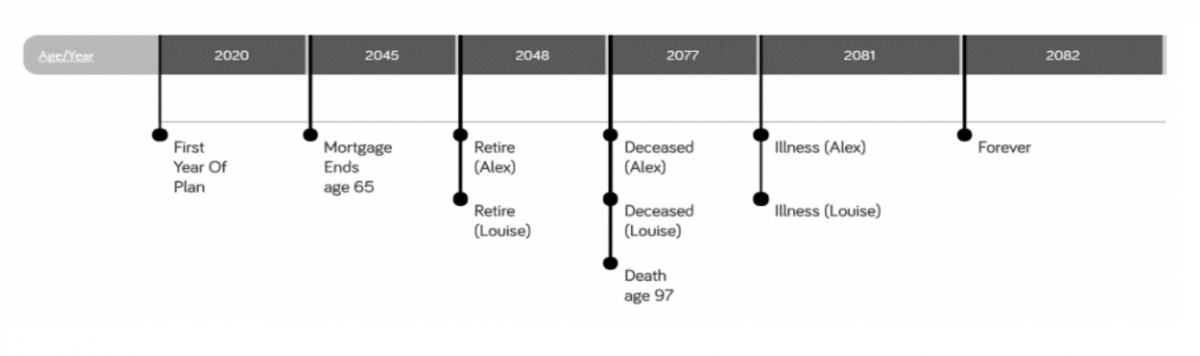

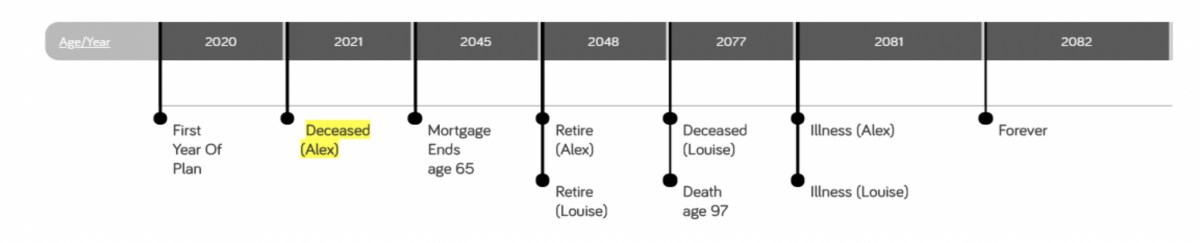

TIMELINE

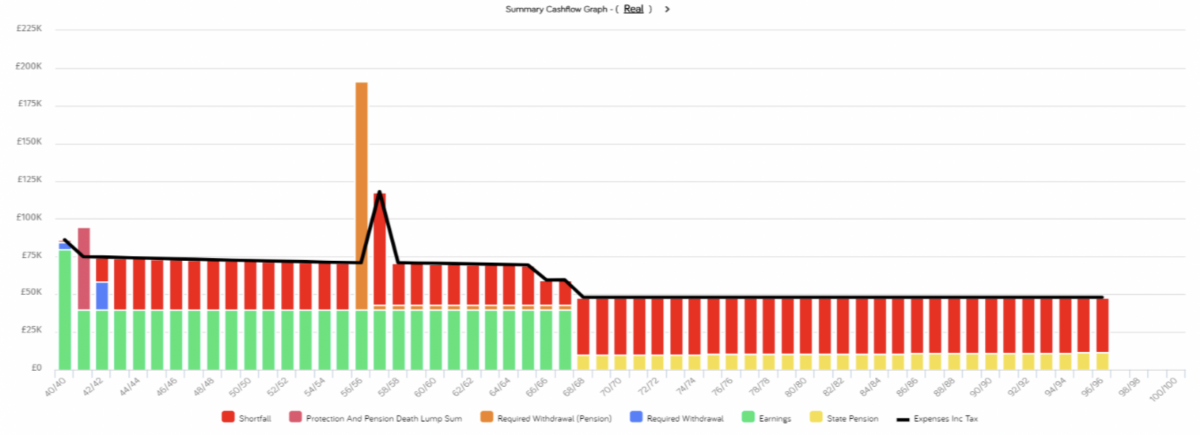

SHORTFALL ANALYSIS

Complete Planning

SYNTHESIS ADVISED IN THE FOLLOWING AREAS:

Family Income Benefit plan | On death, the plan pays a regular tax free income to Louise. The income paid is set at a level that meets the shortfall required to cover the family’s regular lifestyle expenditure on Alex’s death.

Decreasing Term Assurance | On death 1st death, the plan pays a tax free lump sum to the surviving spouse equal to the outstanding balance of their mortgage. This would allow Louise to pay down the mortgage in full relieving her of the stress of having to meet monthly mortgage costs.

Pensions and workplace benefits | We reviewed Alex and Louise’s pension and workplace benefit nominations to ensure that these were appropriately completed.

Independent & cost focused

INDEPENDENT ADVICE TO DELIVER COST SAVINGS

We reviewed the whole of market to ensure that Alex and Louise secured the appropriate cover at a market leading price.

Investments

Not required.

Connected

Solicitor | We introduced Alex and Louise to a private client solicitor to draft appropriate Wills which could account for their wishes on death. Alex and Louise were also able to consider potential guardianship options for Lucie.

Reviewed

We provide Alex and Louise with an annual review to keep then in control and to allow for adjustments.

Alex & Louise are in their 40’s and are parents to Lucie, 10

About this case study & risks

ADVICE | The information which is summarised in this case study does not constitute financial advice and is general in nature. It does not account for your specific circumstances and should not be acted on prior to receiving formal advice from Synthesis Connected Wealth Ltd. If you were to act without receiving advice you risk entering into a strategy and/or product that may not be suitable for your needs.

TAX ADVICE | The Financial Conduct Authority does not regulate tax advice.

INVESTMENT RISK WARNINGS | All investments, which we may undertake on your behalf, are subject to a level of risk. The value of investments and the income derived from them is not guaranteed and can fall as well as rise.

FACTUAL ACCURACY | This case study is based on a fictitious client and has been constructed to provide an example of our planning techniques.

PRODUCT RISKS | Life Assurance plans typically have no cash in value at any time and cover will cease at the end of term. If premiums stop, then cover will lapse.