Estate

CLIENT PROFILE

Jeremy & Mandy are in their late 70s

Objectives & Questions

Jeremy & Mandy wish to explore the following:

Q1) Understand their existing and potential future inheritance tax (IHT) liability

Q2) Understand mitigation strategies that could provide a legacy for future generations whilst maintaining financial independence

Bespoke

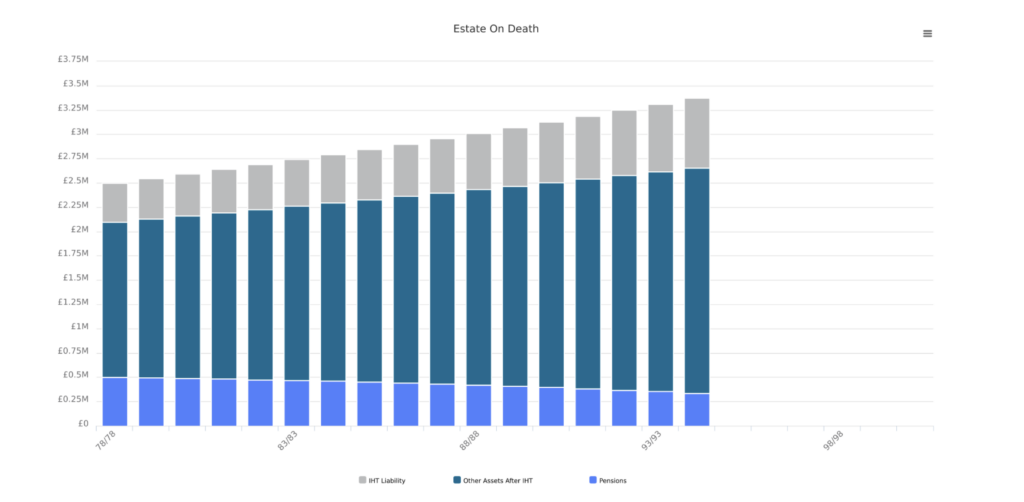

Case Study assumes Jeremy and Mandy have full use of their nil-rate & main residence nil-rate bands. Pensions are deemed outside of their estate.

We calculated their existing inheritance liability sits at £400,000. We were able to project this liability forward using our sophisticated modelling software.

Our model, based on the used assumptions, anticipated that in ‘real terms’ their IHT liability would increase to c. £530,000 at estimated mortality ages.

Complete Planning

SYNTHESIS ADVISED IN THE FOLLOWING AREAS:

We demonstrated various methods to help meet their objectives . This included insurance policies, IHT efficient investment vehicles and outright gifting options.

Recommendation

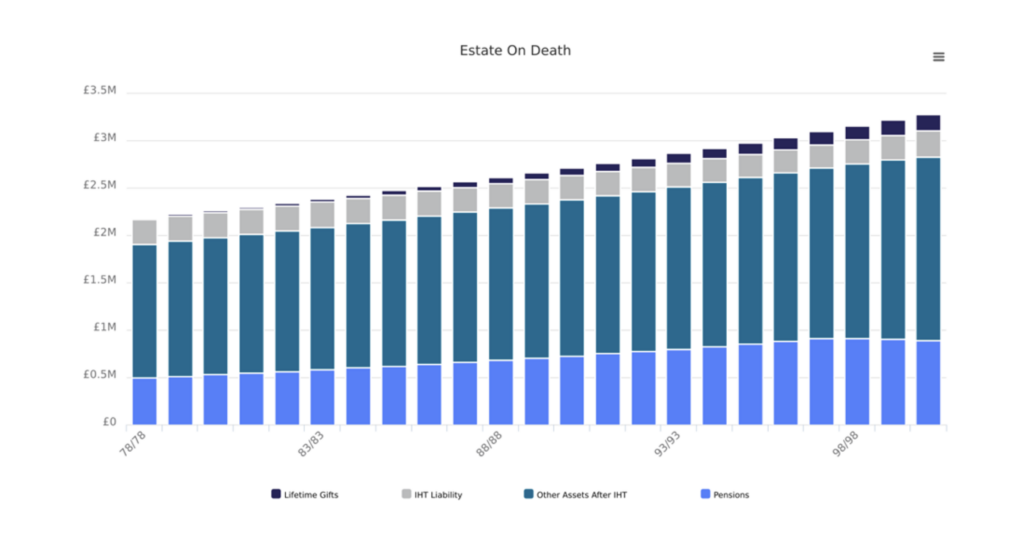

We recommended a trust based invested solution with an initial settlement of £325,000.

This settlement would be exempt from IHT after 7 years and provide an eventual IHT saving of £130,000. By placing the assets into trust, we ensured that all future investment growth was also outside of their estate.

We established a 7-year life assurance policy for £130,000 to provide life cover to coincide with the period prior to the settlement becoming exempt.

We created an ongoing regular gifting strategy to utilise annual gifting exemptions. We also utilised the estate planning advantages of pensions and switched all withdrawals over to their investments.

Our analysis demonstrates that these steps could provide IHT savings of c. £254,000.

About this case study & risks

ADVICE | The information which is summarised in this case study does not constitute financial advice and is general in nature. It does not account for your specific circumstances and should not be acted on prior to receiving formal advice from Synthesis Connected Wealth Ltd. If you were to act without receiving advice you risk entering into a strategy and/or product that may not be suitable for your needs.

TAX ADVICE | The Financial Conduct Authority does not regulate tax advice. Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.

INVESTMENT RISK WARNINGS | All investments, which we may undertake on your behalf, are subject to a level of risk. The value of investments and the income derived from them is not guaranteed and can fall as well as rise.

FACTUAL ACCURACY | This case study is based on a fictitious client and has been constructed to provide an example of our planning techniques.

TRUST ADVICE | The Financial Conduct Authority does not regulate trust advice.