Education

CLIENT PROFILE

Alice is 9 years old and lives with her parents. Her grandparents, Charles and Rita, wish to assist with independent school fees.

Objectives & Questions

Charles & Rita wish to assist with their granddaughter Alice’s educational costs:

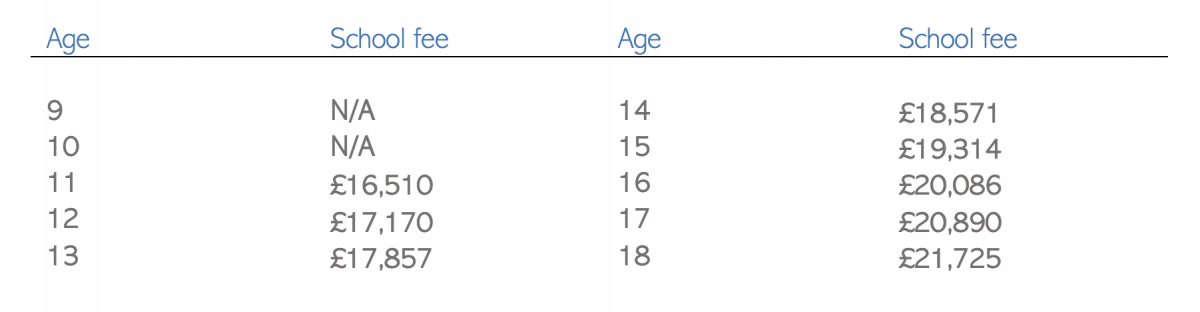

Q1) How much capital needs to be set aside today to meet the cost of school fees between age 11 – 18?

Q2) Are we able to minimise any inheritance tax liabilities?

Q3) Who has control of the funds?

BESPOKE PLANNING

CAPTIAL MARKET ASSUMPTIONS

Complete Planning

SYNTHESIS ADVISED IN THE FOLLOWING AREAS:

Trust planning | We demonstrated that by transferring the capital into trust, after 7 years, the funds will be out of Charles and Rita’s estate. This provides a significant inheritance tax saving. We were able to explore effectively accelerating this reduction by insuring the potential inheritance tax saving for a period of 7 years.

This type of arrangement represents a transfer of wealth. Therefore, Charles and Rita need to accept that these funds cannot be drawn upon personally again.

Control | Charles and Rita with Alice’s parents were appointed trustees. This enabled Charles and Rita to retain control over how the funds were invested and when monies could be distributed.

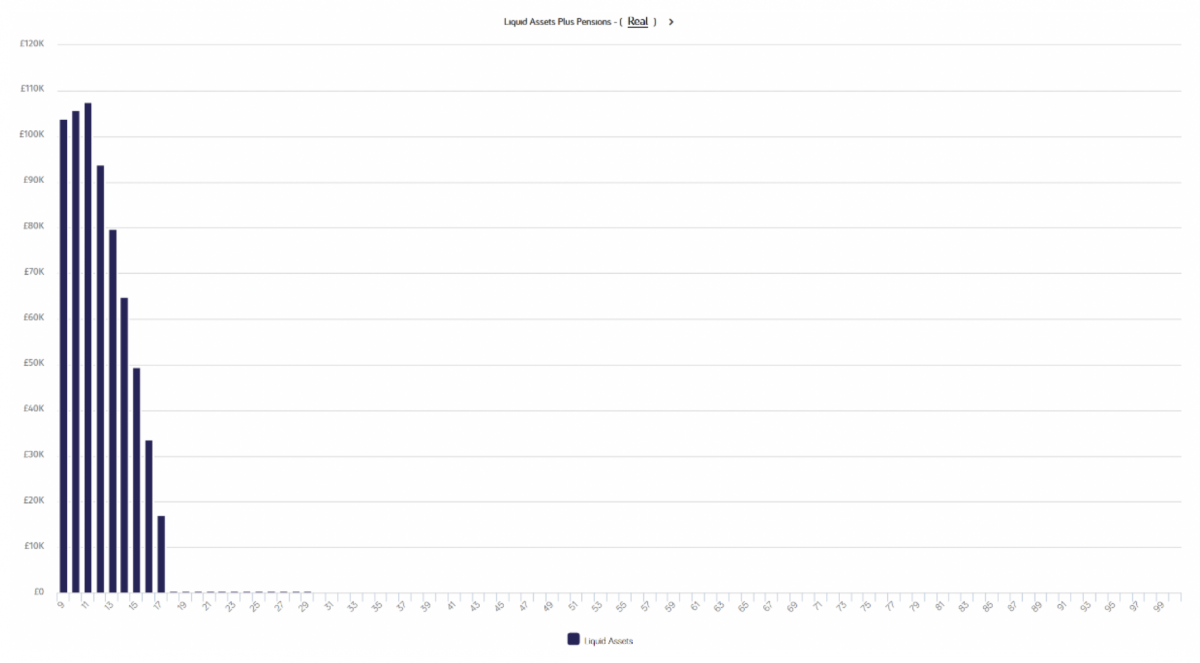

Risk tolerance | We reviewed the trustee’s ability to accept investment risk and devised an investment strategy which aimed to provide ‘real returns’ and protection from unacceptable volatility levels.

Savings vehicle | We recommended a savings vehicle which limited the trustees ongoing tax reporting requirements. This enabled any eventual gains to be assessed against Alice, a non-taxpayer.

Independent & cost focused

INDEPENDENT ADVICE TO DELIVER COST SAVINGS

We provided access to a low-cost savings vehicle that was fit for purpose. This allowed the trustees to make payments for future school fees.

The recommended investment proposition was focused on controlling volatility within an agreed risk mandate. This meant that although returns can’t be guaranteed, expectations around volatility were set.

Investments

We ensured the investments strategy was aligned appropriately to the objective.

Reviewed

We review the performance of the investment annually. This ensures that the level of funds remain appropriate for any changes in anticipated school fee costs and/or investment performance.

About this case study & risks

ADVICE | The information which is summarised in this case study does not constitute financial advice and is general in nature. It does not account for your specific circumstances and should not be acted on prior to receiving formal advice from Synthesis Connected Wealth Ltd. If you were to act without receiving advice you risk entering into a strategy and/or product that may not be suitable for your needs.

TAX ADVICE | The Financial Conduct Authority does not regulate tax advice. Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.

INVESTMENT RISK WARNINGS | All investments, which we may undertake on your behalf, are subject to a level of risk. The value of investments and the income derived from them is not guaranteed and can fall as well as rise.

FACTUAL ACCURACY | This case study is based on a fictitious client and has been constructed to provide an example of our planning techniques.

TRUST ADVICE | The Financial Conduct Authority does not regulate trust advice.