Business Planning

CLIENT PROFILE

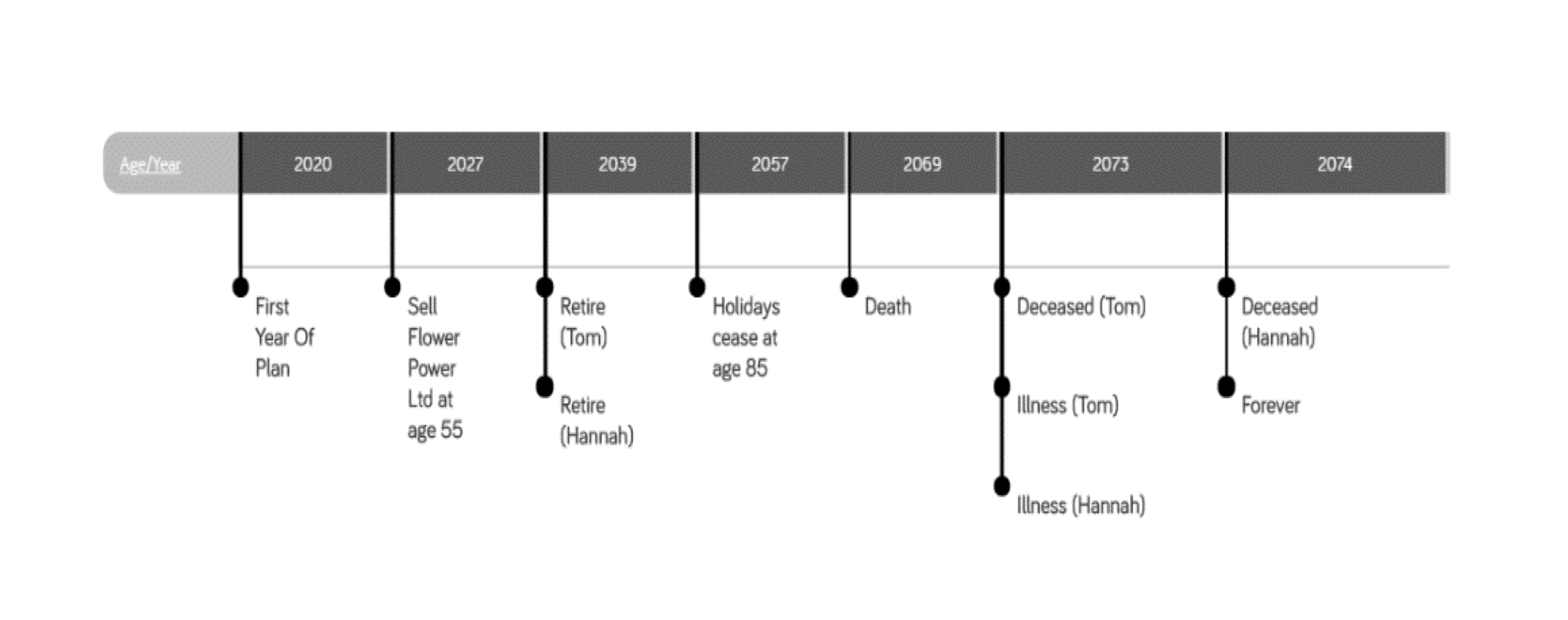

Hannah and Tom run a successful floristry business.

Objectives & Questions

HANNAH & TOM WANT TO RETIRE IN THEIR MID-50’s AND BE FINANCIALLY INDEPENDENT:

Q1) Can we structure our wealth more efficiently, and can we minimise tax?

Q2) How much do we need to save?

Q3) What price do we need to sell our business for?

SYNTHESIS BESPOKE FINANCIAL PLAN

ANALYSIS

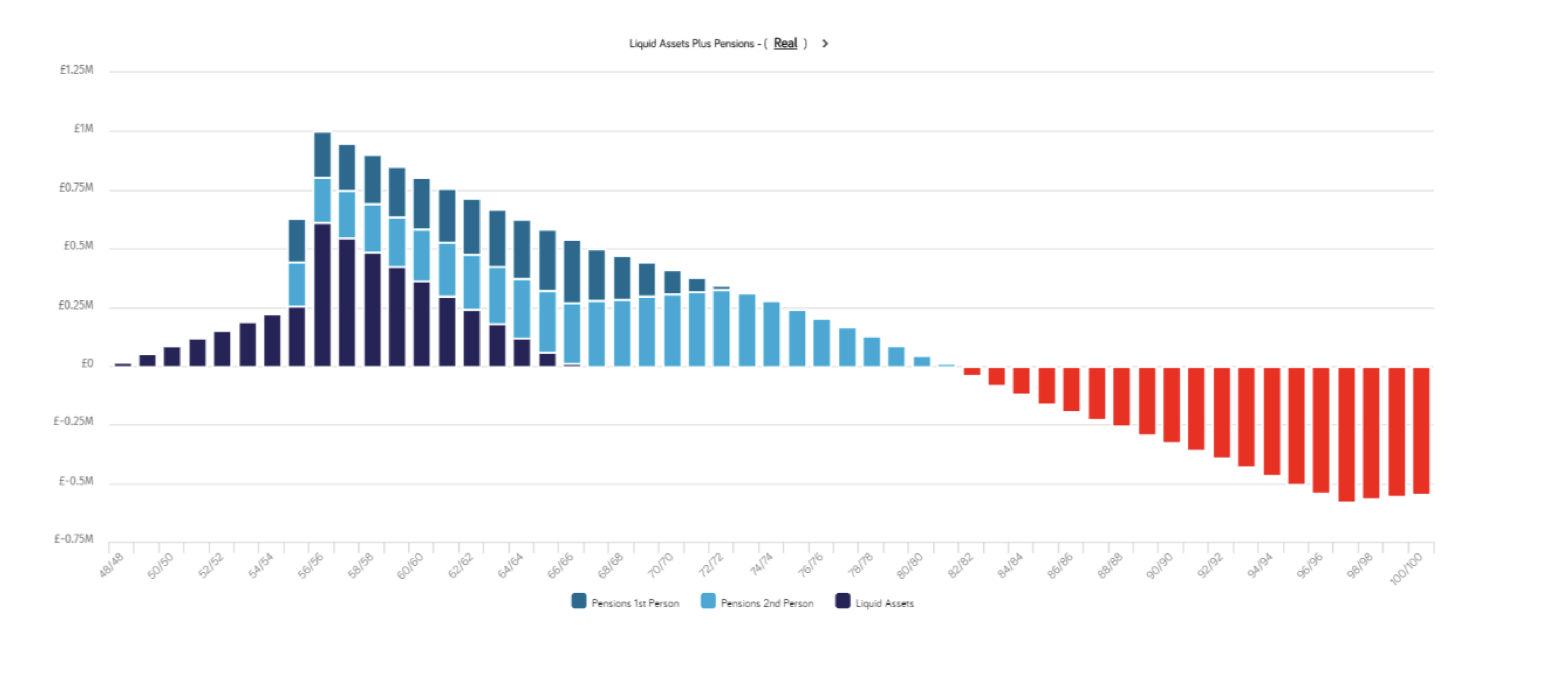

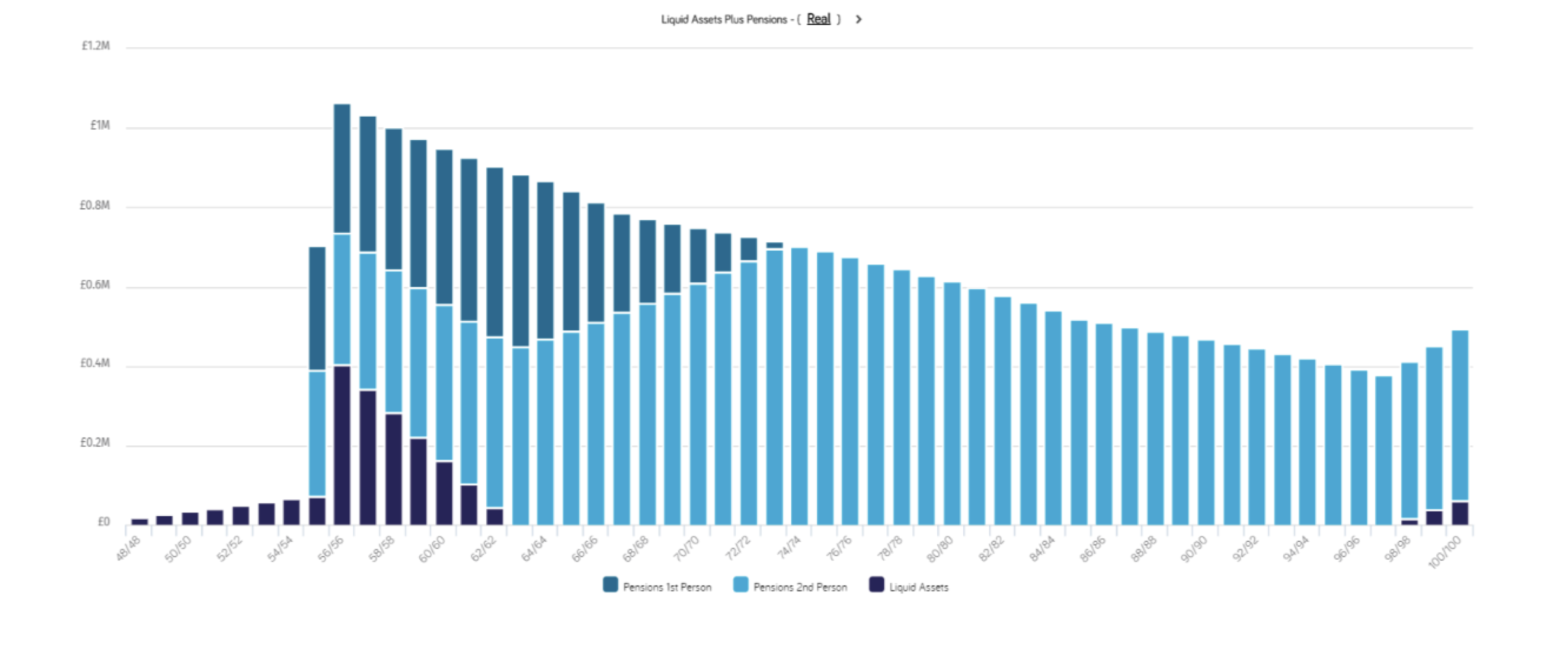

RESULTS

Complete Planning

SYNTHESIS ADVISED IN THE FOLLOWING AREAS:

Retirement funding strategy | Increase Hannah and Tom’s pension funding from the company. In addition, we ensured that Hannah and Tom maximised company dividend drawings within the basic rate band.

Our recommendations increased retirement savings and reduced Corporation Tax, Income Tax and National Insurance costs. In addition, by efficiently extracting funds out of the business we can reduce the reliance on the future sale of the business to support their objective.

Tax efficient investing | We reviewed Hannah and Tom’s existing savings and investments and recommended a strategy to utilise their tax allowances.

Risk tolerance | We reviewed Hannah and Tom’s risk tolerance and adjusted their current investment strategy to one more suitably aligned to their views and objectives.

Independent & cost focused

INDEPENDENT ADVICE TO DELIVER COST SAVINGS

Our review indicated that an appropriate pension and investment account that provided the required functionality was available at an ongoing cost saving.

Connected

Specialist Accountant | We introduced Hannah and Tom to a specialist accountant who helps business owners to structure companies in preparation for sale.

Reviewed

We provide Hannah and Tom with annual reviews to keep them in control and allow for adjustments.

Employee Benifits

ONE TO ONE STAFF MEETINGS| We can arrange to meet with your staff to help them understand their current benefit package and provide information and guidance on key financial planning issues.

GROUP PERSONAL PENSIONS | We can review and help establish appropriate group pension arrangements which comply with current legislation and link with your payroll systems.

GROUP LIFE / DEATH IN SERVICE & INCOME PROTECTION | We can review and provide group protection benefits for your employees.

Protection

SHAREHOLDER PROTECTION | Can ensure you retain control of your business in the event a key shareholder dies. Insurance policies can provide you with capital to purchase the shares of the deceased shareholder.

These can be established under trust with a cross option agreement being used to ensure the surviving key shareholder(s) can purchase the shares at the point of need. We can work alongside an accountant to consider appropriate cover levels, based on your business value.

KEY MAN PROTECTION | Can be used so a business insures itself against the financial loss it would suffer should a key person in their business die or were diagnosed with a specified critical illness, if chosen.

RELEVENT LIFE ASSURANCE| Is a form of death-in-service benefit that is set up and paid for by a company but pays out to a staff member’s or director’s beneficiaries on death.

About this case study & risks

ADVICE | The information which is summarised in this case study does not constitute financial advice and is general in nature. It does not account for your specific circumstances and should not be acted on prior to receiving formal advice from Synthesis Connected Wealth Ltd. If you were to act without receiving advice you risk entering into a strategy and/or product that may not be suitable for your needs.

TAX ADVICE | The Financial Conduct Authority does not regulate tax advice.

INVESTMENT RISK WARNINGS | All investments, which we may undertake on your behalf, are subject to a level of risk. The value of investments and the income derived from them is not guaranteed and can fall as well as rise. A pension can not normally be accessed until age 55 (57 from 2028)

FACTUAL ACCURACY | This case study is based on a fictitious client and has been constructed to provide an example of our planning techniques.

PRODUCT RISKS | Life Assurance plans typically have no cash in value at any time and cover will cease at the end of term. If premiums stop, then cover will lapse.